When it comes to improving your Shopify store profit, we see a lot of eCommerce brands and business owners getting fixated on increasing their conversion rates, whether it be their online store eCommerce conversion rate, their paid advertising or email marketing etc.

There are a lot of things that influence online conversion rates. It can be direct competitors running a big weekend clearance sale, seasonality such as black Friday or Xmas, covid lockdowns and even page speed can all cause fluctuations with your store’s conversion rate.

With a metric that’s this variable, where else can you look to optimise your margins and ultimately improve your Shopify store profit?

Understanding your costs

As a dedicated Shopify agency, we like to go through a process with our clients to really understand their costs and identify where margins are getting diluted. So firstly let’s understand your eCommerce stack and your breakdown of true running costs. We’re not simply looking at your landed cost of goods (COGS) here, we need to dig deeper into what really goes into your cost per transaction.

Some other costs to consider are:

- Payment processing fees

- Pick and pack fees

- Shipping fees – these can also include residential surcharges. Does yours?

- Abandoned cart fees

- 10% off your first order email opt-in

- The list goes on…

Once you’ve created a list with your running costs broken down, you can start to see where you can make improvements in your margins and ultimately store profits.

What’s the uptake on your 10% off first order email opt-in and what would happen if you made that 5%? Or maybe you need to think about having the rule to enforce the average order value of X to qualify for the first order discount.

One of the less obvious and most commonly overlooked points to analyse though is your payment processing fees. This is where you’ll typically uncover some hidden margins.

Are you using 3rd party payment gateways? If so you need to truly understand the payment processing fees you’re being charged for each individual payment gateway and then weigh up whether it’s a financially worthwhile payment option to offer at checkout.

When you have a number of gateways in the mix, your variable payment fees can get even more complicated and range from 1% right through to 6% of the sale in transaction fees.

Shopify payments report

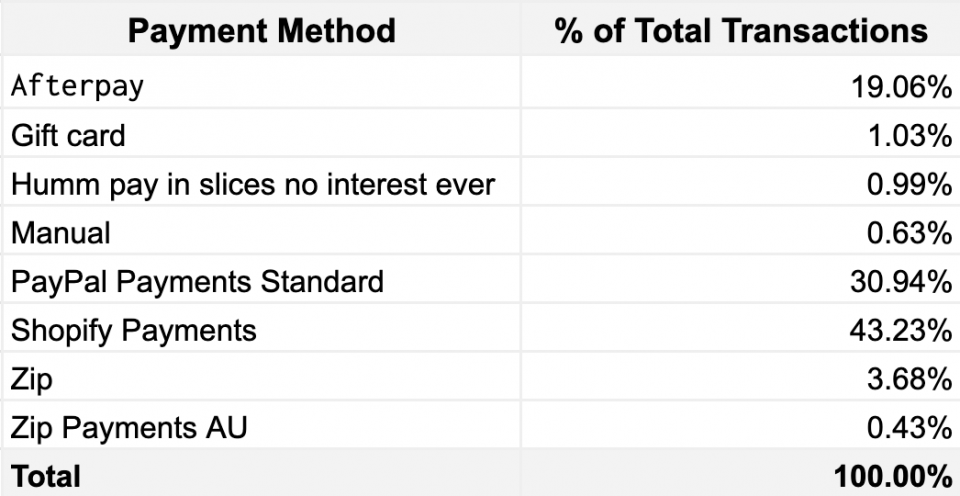

To get a breakdown of what payment gateway your customers are checking out with on your Shopify eCommerce store, simply navigate to your Shopify Admin > Analytics > Reports > Finances > Payments. This will generate a report that looks something like the below.

Shopify payments

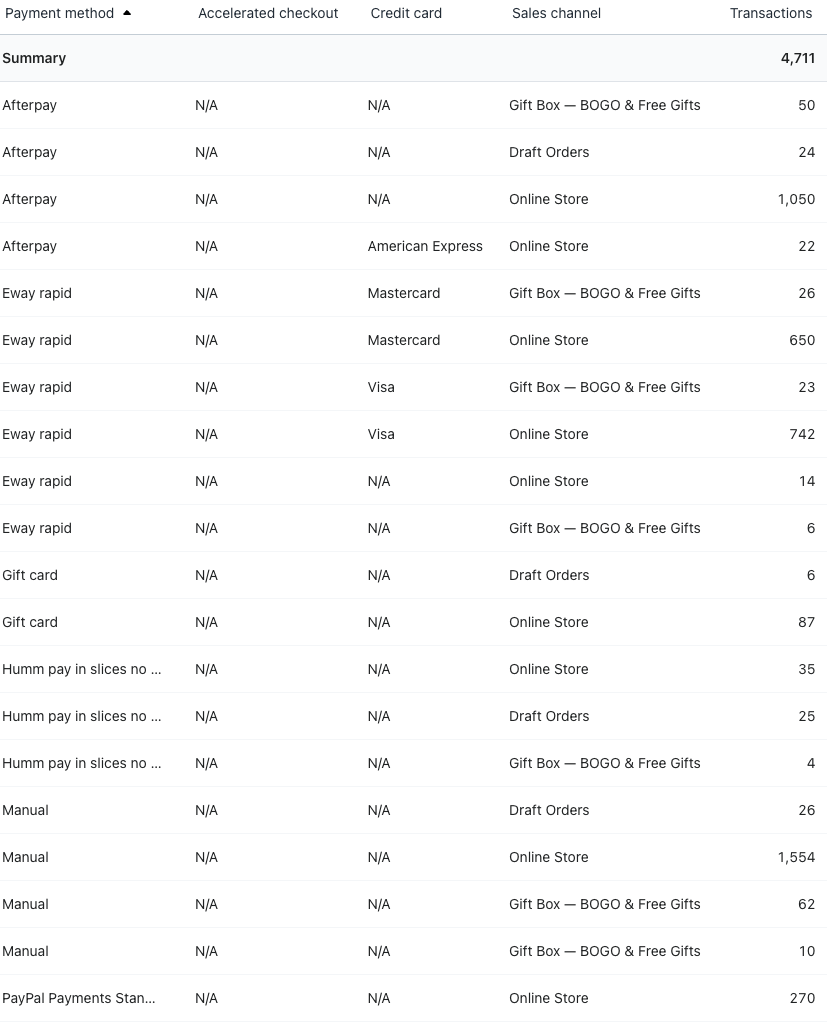

If you’re not using Shopify Payments like the example above, you’d need to quantify whether the rate you’re getting is better than 0.9% per transaction assuming you’re on the Shopify Advanced plan. It’s important to understand that Shopify incurs a processing fee regardless of the payment gateway you’re using.

This is often overlooked by traditional brick and mortar stores when starting their journey online. They have an existing payment gateway provider that they have done business with for a long time, and with a nicely negotiated rate, but when they start out small on Shopify they’re unaware that they will then be charged an additional transaction process fee for using their 3rd party gateway.

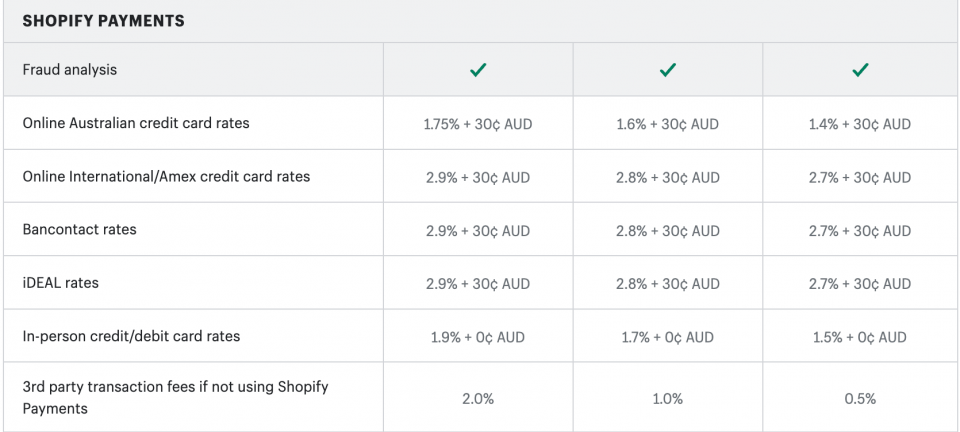

In the table below you can see “3rd party transaction fees if not using Shopify Payments” which tiers in percentage based on the Shopify plan you’ve subscribed to on your stores. Note that 3rd party transaction fees are reduced to 0.15% on the Shopify Plus plan.

An example of a 3rd party payment gateway is Eway, After Pay, Humm, Zip and even PayPal, if it’s not connected via Shopify Payments/ Shop Pay.

To do the numbers on this, let’s say you’re using Eway and you have a rate of 1.2% and you are on the middle Shopify plan, your actual cost per transaction is 1.2% + 1%(processing fee) = 2.2%. You can see how the attractive rate you thought you had can quickly increase by 83%!

If you’ve done any work in the conversion optimisation space then an increase of this percentage would have your CRO agency busting out the Champagne. However, when this increase is reflected by direct costs, and not revenue, then it’s a very different story.

By understanding the Shopify plan structure you could quickly reduce your transaction fees by 22% simply by upgrading to the Shopify Advanced plan. With that said in this above example, I would simply recommend that you remove Eway from your payment profiles altogether and replace it with Shopify Payments. On the Shopify Advanced plan, this would bring your costs down to 1.4% per transaction when customers checkout using Shopify Payments.

It’s important to note that if you’re using Afterpay you’ll still be charged an additional 0.5% per transaction as these are still 3rd party payment gateways.

Revisit your cost of goods (COGS) and factor in these variable payment processing fees to budget what margin you can profitably account for on your store. You might even decide that a particular payment gateway isn’t a profitable fit for you.

As you can see when you start looking outside of the box, you’ll be surprised where you can find that little bit of additional margin. What does an extra 0.5%, 1% or even 3% mean to your bottom line?

You’ll be glad to hear that improving your margins and ultimately Shopify store profit doesn’t stop there.

Break down your transaction report by payment gateway and determine which payment gateway is most used by your customers.

If you have PayPal set up as a payment option, we recommend you try and influence visitors to checkout using the PayPal Pay in 4 option. It still provides the buy now pay later value to your customers, but you can reap the benefits of up to a 60% reduction in transaction fees than its competitor Afterpay. That’s huge, right there you may find yourself a way to pocket up to 3% in additional margin!

Don’t forget to evaluate the refund rate by gateway too. Most payment gateway merchant fees are non-refundable in the event of a refund. If you’ve racked up 4% to 6% in Afterpay merchant fees that have since been refunded, you won’t be seeing that margin back in your pocket…

Think about establishing operational procedures that can help combat refunds from happening on your store.

You by now might be thinking why shouldn’t I just drop Afterpay altogether? Logically it might make sense but from a conversion perspective, it may not. This can vary depending on your type of customers, the average order value (AOV) and percentage of Afterpay checkouts being processed on your store. We always recommend testing what payment methods you show and hide on product pages or even in your checkout in a controlled A/B test first.

Benefits of using Shopify Payments

If you’re on the Shopify platform you can easily see why it might make sense in your business to be prioritising Shopify Payments based on the associated transaction fees. Just be sure to also understand your customer’s preferences when it comes to checking out on your store.

Shopify’s payments can enhance your store experience and even conversions in a couple of ways. If you enabled the dynamic checkout buttons in your theme, you may see very favourable increases in conversion rates, especially on mobile devices.

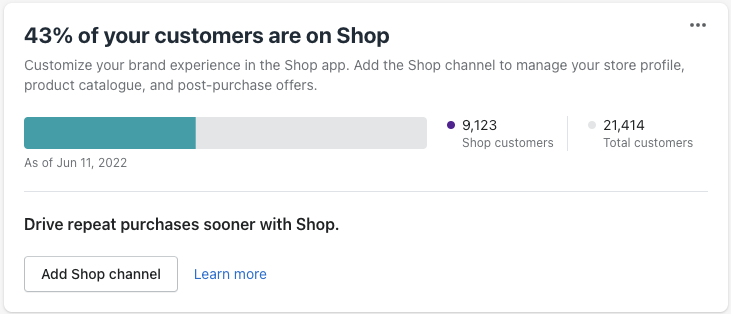

The Shop Pay accelerated one-tap checkout streamlines your customer checkouts and allows them to track all of their orders in one place. With over 100M+ online shoppers worldwide already using Shop Pay, it certainly makes sense to tap into the enhancements this can bring to your store.

Another benefit of Shop Pay is you can enable it as a separate sales channel in your Shopify store to allow your products to be directly found within the Shop App. It’s a win-win, simply add the Shop Channel in your Shopify store and away you go. You might even find that nearly half of your customers are already actively using the Shop app!

As you can see, by looking at your margin in a tactical way, you can unlock hidden revenue that’s potentially leaking through your online ecosystem.

Grab yourself a coffee and start crunching the numbers! Or if numbers aren’t your thing, then reach out as our team would be more than happy to help.